J

Jeanne Stansak

dylan_black_2025

AP Macroeconomics 💶

99 resourcesSee Units

There are a variety of costs associated with unanticipated inflation. Unanticipated inflation is a surprise, meaning that consumers and producers were not given time to adjust in advance. Remember that inflation is a general rise in prices. Economists will make predictions about possible inflation rates based on the current state of our economy however there are times when their predictions are not accurate. As a result of the change between predictions and what the inflation rate actually is there are costs that result. These costs include menu costs, shoe-leather costs, loss of purchasing power, and redistribution of wealth.

Costs of Inflation

Menu costs result from a firm having to change prices. As inflation occurs within our economy, businesses are forced to change any business-related materials that have prices on them like a menu as a result. An example of this would be Walmart having to hire additional workers to replace all the price tags on their products every week. Another example is the owner of a restaurant having to spend an extra three hours a week creating and updating coupons.

Shoe leather costs refer to the cost of time and effort that people end up spending to counteract the effects of inflation. For example, businesses may hold less cash or have to make additional trips to the bank during inflation. A good example of this is each month your rent increases so you can't set up an online automatic payment and as a result, have to pay cash and deliver the rent in-person to your landlord.

Loss of purchasing power occurs because inflation causes the value of the individual dollar to decrease over time. For example, individuals who have the same wage next year as they do currently will not be able to purchase as much. For example, if an individual earns a salary of $60,000 and the inflation rate rises from 3% to 5% from 2018 to 2019 than that salary will not be able to purchase as much in 2019 as it was in 2018.

Wealth redistribution involves the real value of wealth being transferred from one group to another. (i.e. borrowers and lenders). When people are considering lending or borrowing money, they will take into consideration the expected inflation rate. If that inflation rate turns out to be different than anticipated, that affects the amount of interest that is repaid or earned.

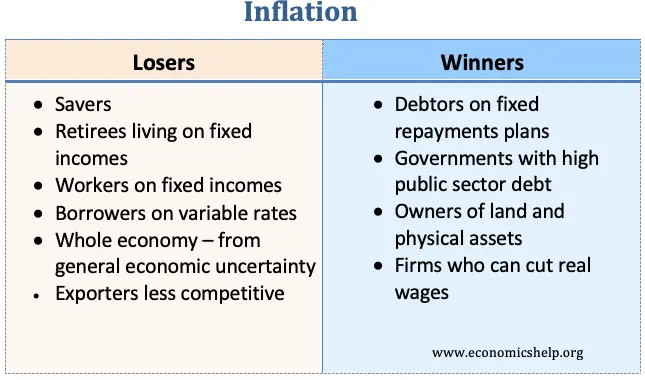

Who Is Helped By Unanticipated Inflation?

While many think that inflation is universally bad, unanticipated inflation actually helps people at times. Here are a few people who may be helped by inflation:

- Borrowers with fixed interest rates: Unanticipated inflation can benefit borrowers with fixed interest rates because it can reduce the real value of the debt. For example, consider a borrower who takes out a loan with a fixed interest rate of 5% per year. If the inflation rate is unexpectedly high and exceeds 5%, the real value of the debt will decline, effectively reducing the burden of the debt. Borrowers with variable interest rates, on the other hand, may not benefit from unanticipated inflation because their interest rates may increase to compensate for the higher inflation.

- Owners of assets: Unanticipated inflation can also benefit owners of assets, such as real estate or stocks, because it can increase the nominal value of their assets. For example, if the inflation rate is unexpectedly high, the nominal value of an asset may increase even if its real value does not change. This can lead to higher profits for asset owners.

- Firms that can cut real wages: Unanticipated inflation can also benefit firms that can cut real wages, as it can allow them to reduce the nominal wages of their workers without reducing their purchasing power. For example, if a firm is facing rising costs due to unanticipated inflation, it may be able to reduce the nominal wages of its workers while maintaining their purchasing power by adjusting for the higher inflation rate. This can help the firm reduce its labor costs and improve its competitiveness.

It's important to note that moderate inflation is actually considered a good thing for the economy! Moderate inflation incentivises spending because prices will be higher later. If we knew that prices were going to decrease, we wouldn't spend now, we'd wait.

Who is Hurt By Unanticipated Inflation?

1. Savers: Unanticipated inflation can erode the purchasing power of savings, as the money saved loses value over time due to rising prices. This can be particularly detrimental to those who rely on their savings for long-term financial stability, such as retirees. To protect against the effects of inflation, savers may invest in assets that are expected to increase in value at a rate that is higher than the inflation rate. These may include assets such as stocks, real estate, or certain types of bonds. Savers may also consider adjusting their saving strategies to account for the impact of inflation on the real value of their savings.

2. Workers on fixed incomes: People who receive a fixed income, such as those on a pension or disability benefits, may find it difficult to keep up with rising prices if their income does not increase at the same rate as inflation. This can lead to a decline in their standard of living.

3. Borrowers with variable rates: Unanticipated inflation can also have negative effects on borrowers if their rates are variable. This is because inflation will lead lenders to increase interest rates to pay for the costs of inflation.

Here's a chart that summarizes some of the material we've covered:

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.