3.5 Equilibrium in Aggregate Demand-Aggregate Supply (AD-AS) Model

3 min read•june 18, 2024

J

Jeanne Stansak

Haseung Jun

AP Macroeconomics 💶

99 resourcesSee Units

Equilibrium AD-AS Model

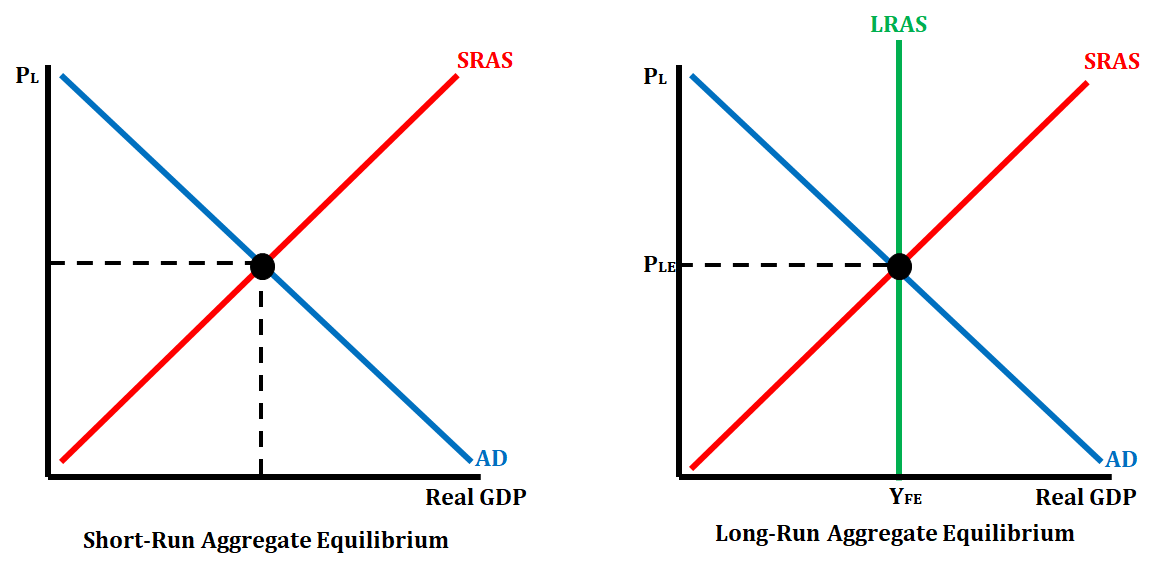

Aggregate equilibrium is very similar to equilibrium with demand and supply for an individual good or service. There are two types of equilibrium when we are referring to the aggregate economy. Short-run aggregate equilibrium occurs when the quantity of aggregate demanded is equal to the quantity of aggregate supply. This is displayed on a graph by the intersection of SRAS and aggregate demand (AD). If you took micro, this'll look familiar.

Long-run equilibrium occurs when the current output is also equal to potential output. This is demonstrated by the intersection of SRAS, AD, and LRAS. This is also referred to as the full-employment level of real output.

Equilibrium Gaps

If the price level increases above equilibrium, then you have a surplus in GDP. This means that your aggregate supply is greater than your aggregate demand. If the price level decreases below equilibrium, then you have a shortage in GDP. This means that your aggregate demand is greater than your aggregate supply.

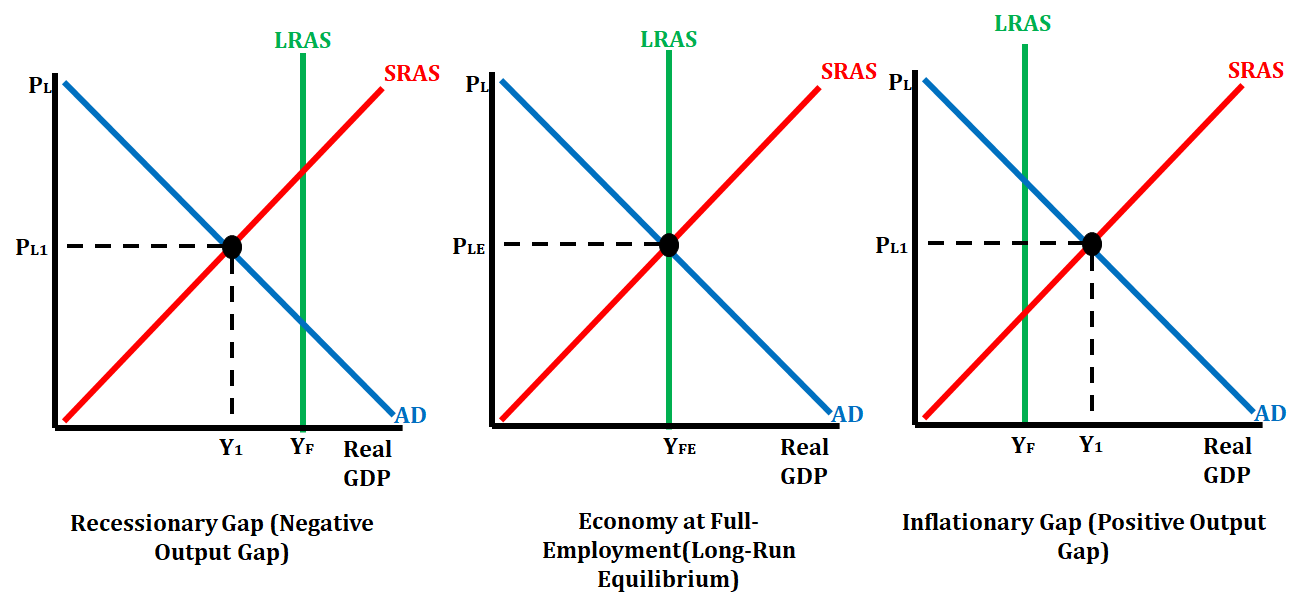

The short-run equilibrium output can be at the full-employment of output, above it or below it. If the short-run equilibrium is below it, then it creates what we cause a recessionary gap (negative output gap). If the short-run equilibrium is above it, it creates what we cause an inflationary gap (positive output gap).

These graphs become super important on the AP exam, so it's recommended that you fully understand these graphs! Just remember that when AD and SRAS intersect but it's to the left of LRAS, it's a recessionary gap because the intersection is "falling behind". Similarly, when the intersection is to the right of LRAS, it's an inflationary gap because the intersection is "moving ahead".

Inflationary Gap

An inflationary gap is a condition where an economy is producing a short-run Real GDP output that is beyond its potential Real GDP output at full employment. At first, it might seem like a good thing that we have a lot of production going on right? But the key to economics is this: equilibrium! This type of situation can lead to an overheating economy, which drives prices up and eventually decreases consumer purchasing power and consumption, which will cause a contraction of the economy. In an inflationary gap, the economy is producing more than the potential Real GDP and their unemployment levels are lower than what is considered full employment (4-6%). The United States economy experienced an inflationary gap in 2006 when its economy was booming, there was low unemployment, wage rates increased, and more households had a larger amount of disposable income and higher purchasing power.

Recessionary Gap

A recessionary gap is a condition where an economy is producing a short-run Real GDP output that is less than its potential Real GDP at full employment. This type of situation leads to the economy producing below its potential, and unemployment increases, and income levels, consumption, and the standard of living decreases. In a recessionary gap, the economy is producing less than the potential Real GDP, and their unemployment levels are higher than what is considered full employment (4-6%). The U.S. economy saw a recessionary gap in 2005 when the potential GDP was 66.86 billion but the real GDP was only 17.95 billion.

Fixes

So how would we fix these gaps? 😊 If I tell you now, it would be a spoiler for topic 3.7 and 3.8!

A quick sneak peak: either we can let the economy fix itself or let the government handle it through fiscal policy 😆 Ever heard of those!?

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.