J

Jeanne Stansak

Haseung Jun

AP Macroeconomics 💶

99 resourcesSee Units

Long-Run Adjustment

When situations happen in the short-run that shift either aggregate demand or aggregate supply, there has to be an adjustment back to the long-run. In the absence of government intervention, the economy self corrects itself in a variety of different ways. In a sense, long term adjustment is basically price adjustment. It's about bringing things back to long-run equilibrium.

Shocks

Shocks are never anticipated. Shocks move the AD curve, but one thing to keep in mind is that it only matters in the short run. If there is a shift in the AD curve, yes output and unemployment will change in the short run, but it won't in the long run. That's why in the long-run, everything will be adjusted back to equilibrium. But what if the shock is permanent?

If the shock is permanent and makes the entire economy less productive, the entire capacity of the economy will decrease. In this case, LRAS will shift to the left (think of this as a shrinking of the production possibilities frontier). Because production costs are now higher, SRAS will also decrease and output will be permanently lower, leading to a permanently higher price level.

Therefore, only an increase in LRAS will lead to a great output of the economy in the long-run! Remmeber, an economy's ability to self-adjust does not depend on AD or SRAS. It actually depends on its resources! This is why moving LRAS to the right (expanding production possibilities frontier) will improve the economy and its ability to produce at full employment.

These self-correcting mechanisms enables the economy is correct itself without much government intervention

Let's look at all the various ways the economy can self correct itself back to the long-run. These are all situations where you begin in long-run equilibrium, a change occurs to move you to short-run and the economy has to self-correct back to long-run equilibrium.

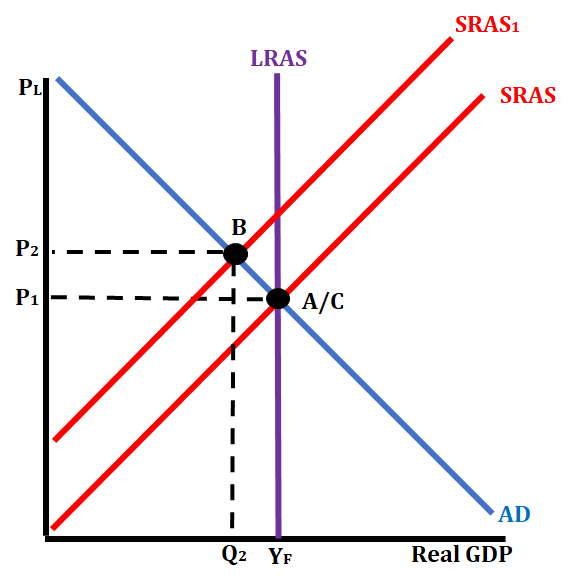

Recessionary Gap

You'll remember from earlier that during a recessionary gap, the equilibrium (B) is on the left side of LRAS. SRAS1 and AD are intersecting at B instead of It describes a situation where the economy is producing within its production possibilities frontier. The gap between Q2 and Yf describes the shortfall of real GDP and from full employment. As you can see, LRAS does not intersect at B, but in order to have a long-term equilibrium, we need LRAS to intersect as well.

This is because recession causes the economy to not take advantage of all of its resources like labor. Because labor is not used at full potential, workers will ask for businesses to lower their wages in an attempt to increase employment. As a result, firms will increase output, shifting SRAS to the right. Since the worker's wages are decreasing, there is a decrease in production costs for firms. This will cause the economy to self-correct by moving from SRAS1 back to SRAS.

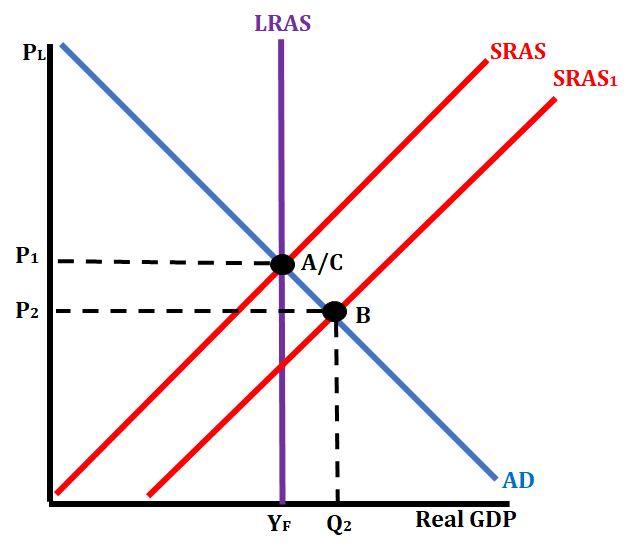

Inflationary Gap

Inflation happens when the economy is over-producing. The equilibrium (B) is on the right side of LRAS and real GDP is above the full-employment potential. But because LRAS doesn't intersect SRAS and AD, we have a problem. High production can strain resources and labor is working overtime. This will cause workers to ask for an increase in wages and cause supply to go down. This will then cause a decrease in aggregate supply (SRAS1 to SRAS) bringing the economy back to long-run equilibrium.

This is how the economy self corrects itself after a short-run increase in aggregate supply. After the long-run adjustment the price level will be brought up to P1. Inflation is the direct result of this long-term adjustment. If SRAS didn't correct on its own, we wouldn't have inflation. So in order to fix inflationary gaps without an inflation, there are things called fiscal and monetary policies that fix the issue in a different way.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.