6.6 Real Interest Rates and International Capital Flows

2 min read•june 18, 2024

J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

6.6: Real Interest Rates and International Capital Flows

Capital flow is the movement of money for the purpose of investment, trade or business production.

There are two types of capital flow: (1) inbound capital flow and (2) outbound capital flow.

Inbound capital flow is the injection of funds into a domestic economy that occurs through the purchase of domestic assets by foreign investors. An example would be a Japanese investor purchasing assets in the United States because they have a higher interest rate compared to similar assets in Japan. These domestic assets include stocks, bonds, or any other interest-bearing accounts. When real interest rates are high, it generates inbound capital flow. This is due to the fact that foreign investors look to invest their money into assets that have high-interest rates because they can earn a higher profit.

Outbound capital flow is the extraction of funds from a domestic economy that occurs through the purchase of foreign assets by domestic investors. An example of this is an American buying assets in Germany because they are yielding a higher interest rate, and they can earn more by doing this. Just like with inbound capital flow, these assets can include stocks, bonds, or any other interest-bearing accounts. When real interest rates fall, it generates outbound capital flow. This is due to the fact that domestic investors look to invest in other countries because the interest rate is higher there than in their own country.

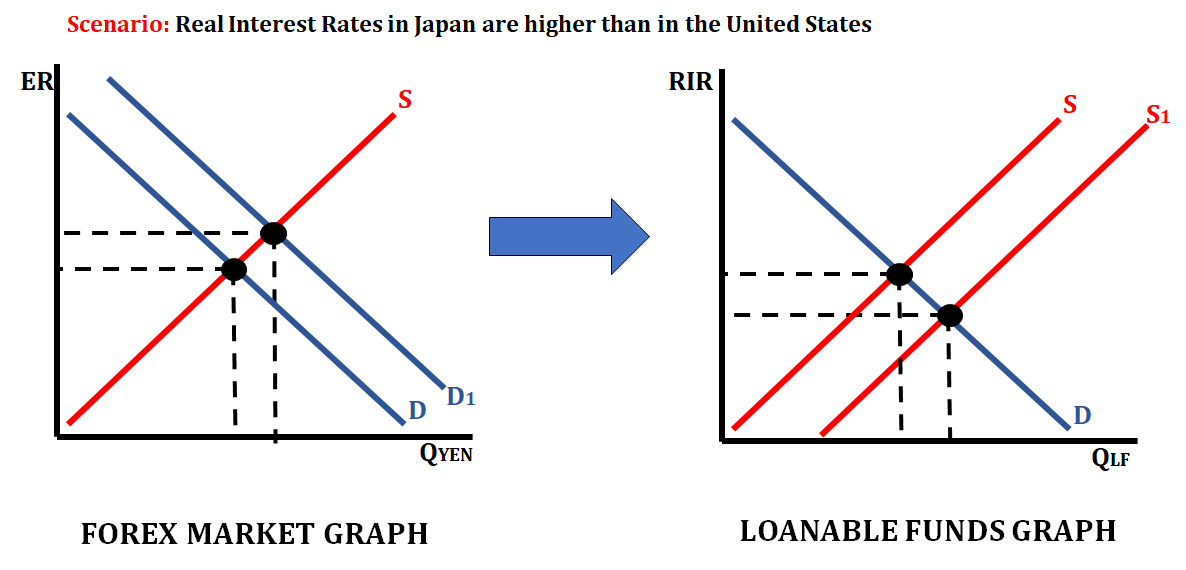

The inflow or outflow of capital affects foreign exchange markets as well as the loanable funds market. Let's look at this effect in a graphical representation.

In this particular situation, since interest rates are higher in Japan than they are in the United States, there is an increase in the number of Americans that are looking to invest in Japanese interest-bearing assets. When they do this, they will increase the demand for the Yen because they will need to exchange their dollars for the Yen. As a result, this will increase the amount of money that is available in loanable funds in Japan.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.