A

Afifah K.

Financial Aid 😱

22 resourcesSee Units

What is FAFSA?

What it stands for, who is eligible, and everything about how high Schoolers should use FAFSA® . It is often misspelled as FASFA but get it right! Both Fs come before the S. FAFSA stands for Free Application for Federal Student Aid.

Basic FAFSA® Definition and Information

Undergraduate and graduate students use the FAFSA® to apply for federal and state financial aid. It is an application that collects personal and family financial information to help with student loans and paying for college. Most colleges will require FAFSA® to determine your eligibility for school aid.

Why should you apply to FAFSA®?

According to College Board, you “automatically qualify for a low-interest federal loan when you submit a FAFSA.” A low-interest federal loan usually is less expensive to repay than a private student loan. Applying won’t cost you anything, so it’s recommended everyone try to apply to FAFSA®. In addition to acquiring loans, many scholarships and work-study programs also require the FAFSA®.

Important FAFSA® Deadlines

There are a few types of FAFSA® deadlines, but regardless you should apply as soon as possible. This link has all the FAFSA deadlines in all categories discussed above; it’s always a good idea to double-check.

Tip! Financial aid comes on a first-come, first-served basis, so it’s best to submit the FAFSA® as soon as possible after the October 1st opening. Don’t wait until the last minute to apply!

Note: Contact the financial aid office at your school to determine which school year you should select when filling out the form if you are applying for summer aid. If you want you can add these deadlines into your scholarship and college tracker, check out this example of a deadline tracker.

- College deadlines: You will need to check in with different colleges to determine the specific FAFSA® deadline for their financial aid offices.

- State deadlines: Check your state’s FAFSA® deadline, especially if you are applying for state-based aid.

- Federal deadline: Remember that June 30 is the last day you can apply for federal aid for the following academic year. June 30th is the absolute last day you can apply if your college and state deadlines are not earlier.

What can I qualify for?

You can qualify for need-based aid, including federal loans, grants, and work-study funds when you apply for the FAFSA. The amount of financial assistance you receive depends on your individual and unique circumstances. Check out this financial aid and FAFSA calculator for more help.

- Grants are financial awards that you do not need to repay.

- You can receive loans based on varying factors such as the cost of attendance and financial need. Students will need to pay back loans as well as the interest they accumulate. Loans have different repayment guidelines and usually won't need to be repaid until you stop attending school.

- Work-study programs provide aid in exchange for working on campus.

FAFSA® considers two main factors: cost of attendance (COA) and estimated family contribution (EFC). COA is the estimated sum of the tuition and fees, room and board, transportation, and supply cost. EFC considers your existing financial resources and determines how much you or your family can pay toward a college education.

Your financial need is determined by subtracting your EFC from your COA. You can find calculators online to get an estimate!

Tip! Make sure to thoroughly fill out your forms, as finance errors often result from incorrect or missing FAFSA® information. It should take around an hour to fill out the FAFSA®.

Additionally, you may also receive non-need-based aid offers. These are determined by academic merit, career goals, or demographics. Your school uses your COA and subtracts any provided financial aid to determine non-need-based aid.

What students are eligible for the FAFSA®?

There are several requirements for the FAFSA®, check them out below.

You must be a United States citizen or meet the non-U.S. requirements, hold a valid Social Security number, and have a high school diploma (or equivalent).

You can submit the FAFSA® every year, even in college, if you want additional aid. Even if you think you or your family makes too much money for financial assistance, you should still take the time to complete it. Don’t assume you don’t qualify! Officials look at many aspects when determining financial need, not just income and assets.

Note: If you are were assigned the sex of male at birth and are between the ages of 18 and 25, you are required to register with the Selective Service System. If you were not previously registered, you can select “Yes” when asked if you would like to qualify. You will not be able to receive federal student aid otherwise.

Unfortunately, undocumented students can not receive financial aid through FAFSA®. Other disqualifications from the application include drug-related convictions or faults on previous financial aid.

Tip! Use this site to determine if you are a dependent student applying for federal aid before you apply, it will save you extra work later! Remember that anyone can apply, determining your status beforehand will just help you get through the process a bit faster :)

The Application Process for FAFSA®

The FAFSA® opens for the following academic year on October 1. Make sure to include this date in your college application checklist. There are three ways to complete the FAFSA®:

- You can find the online FAFSA® website at: fafsa.ed.gov. Caution! This is the only place to apply; make sure you are not on a scam site!

Tip! Make sure the pop-up blocker in your browser allows pop-ups from fafsa.ed.gov. Here are instructions on how to do so!

- You can use the myStudentAid app, available on iTunes and Google Play.

- You can also print the FAFSA® form, and then submit it by mail. Mail to the address provided on the form.

- The 2021-2022 form for printing

- You can also request a print-out of the form by calling 1-800-4-FED-AID (1-800-433-3243) or 334-523-2691.

For more details about the application process check out this guide on how to apply to FAFSA®.

Tip! Use the online or app option, as they offer in-site tips to help you answer the questions.

How to create a FSA ID or FAFSA® ID?

When you fill out the FAFSA® electronically (through the app or fafsa.gov), you will need to make a federal student aid ID (FSA ID). The FSA ID is a username and password that allows you to electronically sign your form, access the myStudentAid app, sign loan contracts, and view your information online. This is your login for your FAFSA® portal when you're applying and into the future.

You cannot access the myStudentAid mobile app at all without an FSA ID, it is necessary to login. When creating the FSA ID, your personal info will be requested. Ensure that you enter your name and social security number exactly as they appear on your social security card. (No shortened versions of your name or nicknames!) Later, when filling the FAFSA® form, make sure your FSA ID information matches.

Your parent will also need to create an FSA ID so that they can sign your application electronically and be able to login. This parent should be the one whose information you use on the general FAFSA® form. They will not be able to create an FSA ID without a social security number. If this is the case, you can print the signature page when you get to the end of your FAFSA® form on fafsa.gov.

Make sure to keep your and your parent’s FSA ID separate and private.

Tip! Creating your FSA ID ahead of time is super helpful to avoid mistakes when filling the FAFSA® form later on.

Extra Tip! If you log in to the FAFSA® form with your FSA ID, it will automatically load certain information into your application! This a huge time saver. 🕑

Optional: Creating a Save Key

You will have the option to create a “save key”. This is a password that you’ll use to access your FAFSA® form if you want to work on it from different locations and times. You and your parents can use this to access the FAFSA® form as well. This is another part of the application process and another aspect of the login process.

FAFSA® Application

Double-check that you are using your FSA ID to fill out the form and not your parents. Also, if this isn’t your first year doing the FAFSA®, you can renew your form! This way, some of the non-financial questions will be prefilled for you.

If you are curious about what the form looks like, this FAFSA worksheet page gives an idea of what types of questions you may be asked. Note that you will NOT be asked to pay to apply.

Tip! Use a personal email permanent email address on the form, not a school email, so you have access to your account throughout college.

Extra Tip! Select the blue and white question mark icon next to a FAFSA® question to view a “tooltip” for assistance!

What do I need to apply to FAFSA®?

Depending on your personal information, you will need the following information or documents:

- Your Social Security number

- Your driver’s license number if you have one

- Your Alien Registration number (if you are not a U.S. citizen)

- Federal tax information or tax returns (including IRS W-2 information)

- IRS 1040

- Records of your untaxed income, such as child support received, interest income, and veterans noneducation benefits

- Information on savings, investments, and assets

You will need the above information from your parents and/or spouse if you are a dependent student. Make sure to be in touch with family beforehand so you have all the necessary information to complete the form. Check this page on how to fill out the FAFSA® for more info and special circumstances, such as out-of-the-US residency.

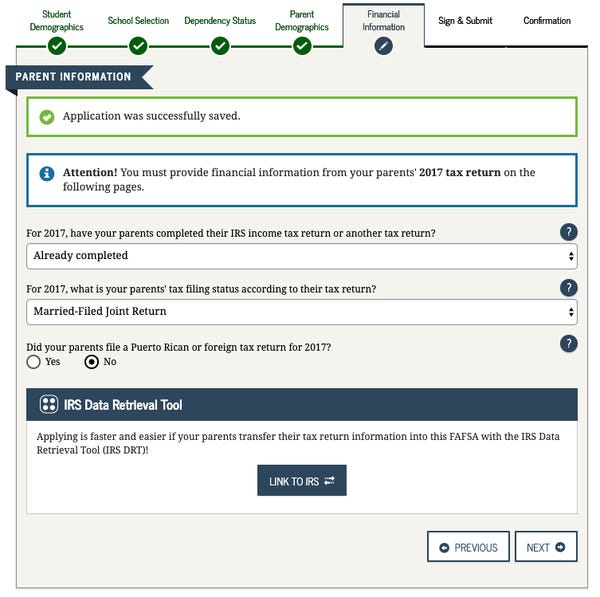

Tip! To fill the form more efficiently, you can automatically transfer your tax information using the Internal Revenue Service Data Retrieval Tool (IRS DRT). This is a graphic outlining the FAFSA® instructions.

Image Courtesy of Business Insider

Extra Tip! If you’re concerned about providing your personal information on the log-in page, choose the virtual keyboard option for additional security.

Online FAFSA® forms require 3-5 days for processing, while mailed applications take 7-10 days. Once everything is processed, you will receive a Student Aid Report (SAR), either by mail or online, depending on how you submitted the form. See the sample below.

Listing Schools on the FAFSA

You must list at least one school to receive your information, and you can add in more as you prefer. The schools you list will use your FAFSA® information to help determine the types and amounts of aid you may receive.

Some states require you to list schools in a particular order (for example: you may need to list a state school first). Check this site for details on a case-by-case basis.

You can list up to 10 schools online/in the mobile app and up to four schools on the FAFSA® PDF. Schools you list on the application will automatically receive your FAFSA® results. Schools will not be able to see which other schools you listed on your FAFSA® form.

If you're still working on your list no worries, but for some extra help check out how to create a college list with this helpful guide!

Tip! You should add any school you plan to apply to, even if you haven’t been accepted yet.

FAFSA® Submission

You will see a confirmation page once you have successfully submitted the FAFSA® form online. If you provided an email address on the form, you will also automatically receive the confirmation page.

Image Courtesy of Alaska Commission on Postsecondary Education

Make sure to review your information and note if there’s a need to make changes or corrections to your application. If you have an incomplete FAFSA® form, your SAR will not have an EFC. You need to look at the "comments" section of your SAR to make sure your FAFSA application was processed.

This site covers the actions to take change your FAFSA application once this process is complete.

Tip! There are a few differences between the emailed confirmation, the SAR, and the one confirmation on the FAFSA site. You should print and save your confirmation pages to keep track of them.

Extra Tip! Keep all the documents and forms you used for information while filling out the form, in case you need them later.

How to Change an Application After Submission?

If you notice mistakes on your SAR, make sure to add missing or incorrect information to your FAFSA® form and then resubmit.

If your or your family’s financial situation changes mid-year from what is on your federal income tax return, you may be able to have your financial aid adjusted. Contact your school directly.

You can also update contact info, marital status, or dependency change and remove/add schools throughout the year. Simply log in with your FSA ID and password, or update by hand, sign, and mail back the form.

Note: Tax information imported from the DRT cannot be changed.

Alternatives to FAFSA: The CSS Profile

The College Board’s CSS Profile™ is something you should fill out in addition to the FAFSA rather than instead of completing the FAFSA. CSS stands for College Scholarship Service. The benefit of the CSS Profile is that it is used by hundreds of institutions to award financial aid and scholarships. The drawback is that you need to pay per organization in order to share your profile with a school or other organization. You may even be asked to complete a CSS Profile with a specific scholarship you are applying for. When deciding where or not to complete the CSS Profile, you should review the list of schools and other institutions that use it so that you know whether it is worth it for you to pay the fee to send it. At least with FAFSA the first F stands for FREE, so you don't have to spend money to try and get money. 😭

Browse Study Guides By Unit

👛Paying for College

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.