How to Calculate Your Financial Aid Needs

5 min read•july 11, 2024

Daniella Garcia-Loos

Financial Aid 😱

22 resourcesSee Units

Financial Aid Survival Guide

Financial aid is easily one of the most stressful 😰 aspects of the college application process, but once you break it down into digestible steps, it becomes less intimidating. Here are some steps to take in order to make this process easier!

Talk to your Guardians

Calculators, charts, and estimates 📈 will do you no good if the person paying for your education has an entirely different idea about what they can afford. The first step in determining how much financial aid you will need is to converse with those contributing to your college expenses 💰. Specifically, you should ask how much they are willing to contribute. If you are a first-generation college student or an immigrant, this may be a difficult conversation to have, so here are some tips to make the conversation go smoother.

Quick Tips:

- Be transparent and honest about expenses

- Write down all of these numbers for future reference

- Ask if there is any money in a savings account set aside for college, such as a 529 Savings Plan

- Be upfront about how much you think you will be able to contribute from working over the summer or during the school year

- Ask how much they are willing to contribute per year/semester towards tuition and other personal expenses

- Ask for ideal numbers and limits

- Have a conversation about student loans

- Be thankful and cooperative!

For more information and basics on financial aid check out this article on everything you need to know for college financial aid.

Calculate your estimated EFC

EFC is your Estimated Family Contribution, which is calculated 🧮 using the FAFSA (opens October 1st!) and helps universities determine how much aid they will give you, alongside the CSS Profile. While your EFC will likely not be the exact amount you will have to pay for college, it can be a good indicator.

You can estimate your EFC using websites like College Board and Finaid.org. These websites are not entirely accurate and should not be used in exchange for the number given by the FAFSA report, which you’ll receive one to two weeks after filling out the FAFSA 📑.

What is the CSS Profile? And do I have to fill it out as well as FAFSA?

The CSS Profile is another financial aid application, which costs around $16 per school, and is created by College Board. Most private schools will require you to fill it out alongside FAFSA, while most public schools only require FAFSA or your state’s financial aid application. Check the website for each school on your list to find out! The CSS Profile includes similar information to FAFSA, but it's typically more detailed. It also includes IDOC, which is something a limited number of schools require, and is essentially a secure way to upload documents related to your finances such as tax returns or W-2’s.

Check out these articles to learn more about what FAFSA is and the FAFSA application process.

Use the NPC for each of the schools on your list

Net Price Calculators, or NPCs, will become the bane of your existence 🙅 throughout the college application process. NPCs are calculators personalized for each school that can estimate the financial aid they will give you if you are accepted. You may need to ask your guardians for pertinent tax information from the previous year (such as Adjusted Gross Income and asset information) in order to get an accurate estimate from these calculators.

CollegeBoard offers an NPC service for many schools, which can be accessed here. If you connect your account 🧑💻, you won’t even need to retype your information for each school! Schools that are not on that website will typically have a financial aid estimator somewhere on their own website in the financial aid section.

You should use the results from these calculators to reflect on the affordability of each school you are considering and evaluate if it is even worth applying to. Always try to make sure your safety schools are not just likely to accept you but also affordable and within budget for your family!

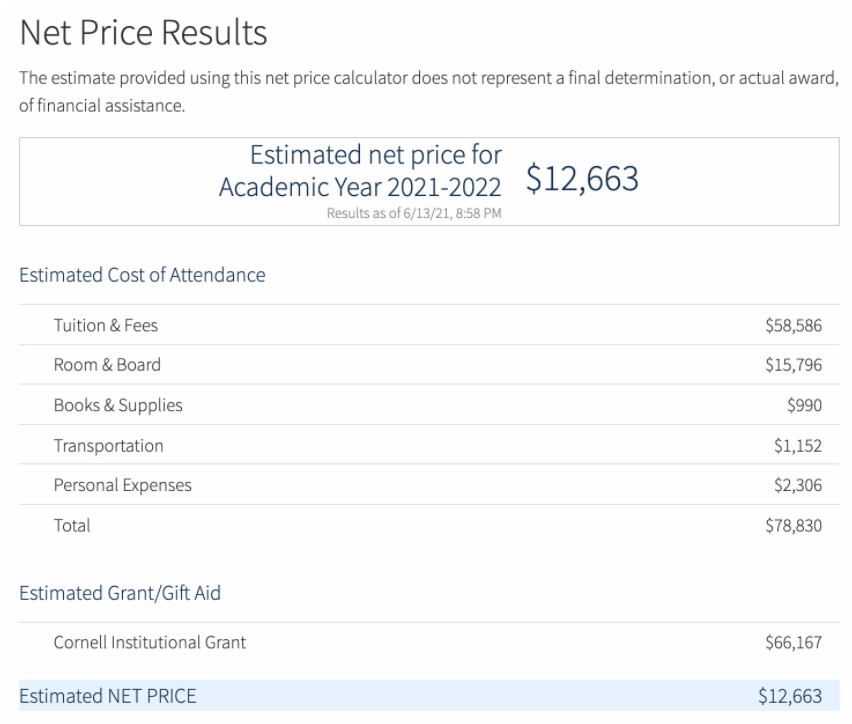

Below is an example result page from one Net Price Calculator:

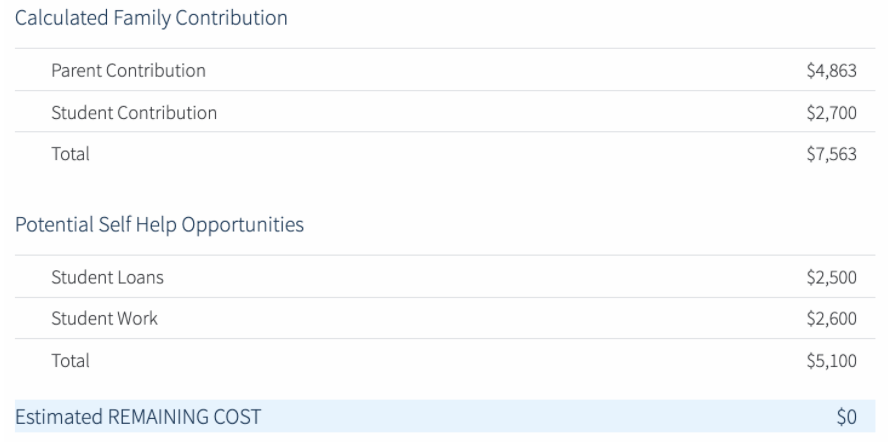

Some will even offer potential breakdowns on how to tackle the net price:

How to Use Spreadsheets to Calculate Financial Aid

Ok, so now you have all of this information hopefully written down as you stare at your computer screen blankly, trying to make sense of it all. Your saving grace? Spreadsheets 🙏

Spreadsheets are a profoundly personal organizational tool, but I’ll share some ways I organized my information throughout this process.

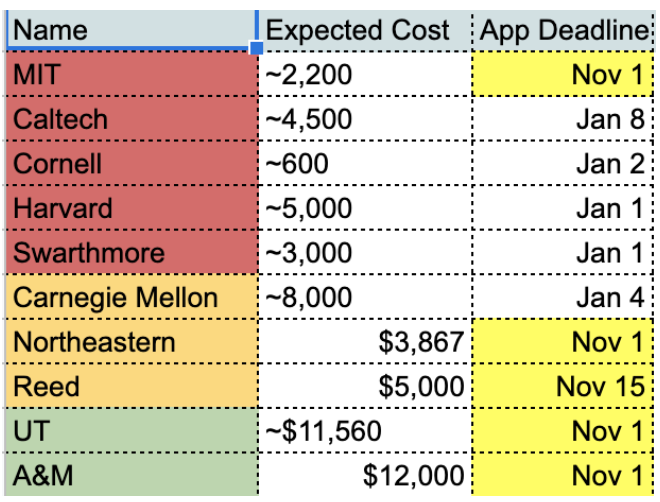

First, I added the results of the aforementioned NPCs to each of the schools on my list. This helped me make sure every school on my list was affordable and that I was aware of the costs before applying. Peep the color coding and formatting 💅.

Image is the author's original work via Google Sheets

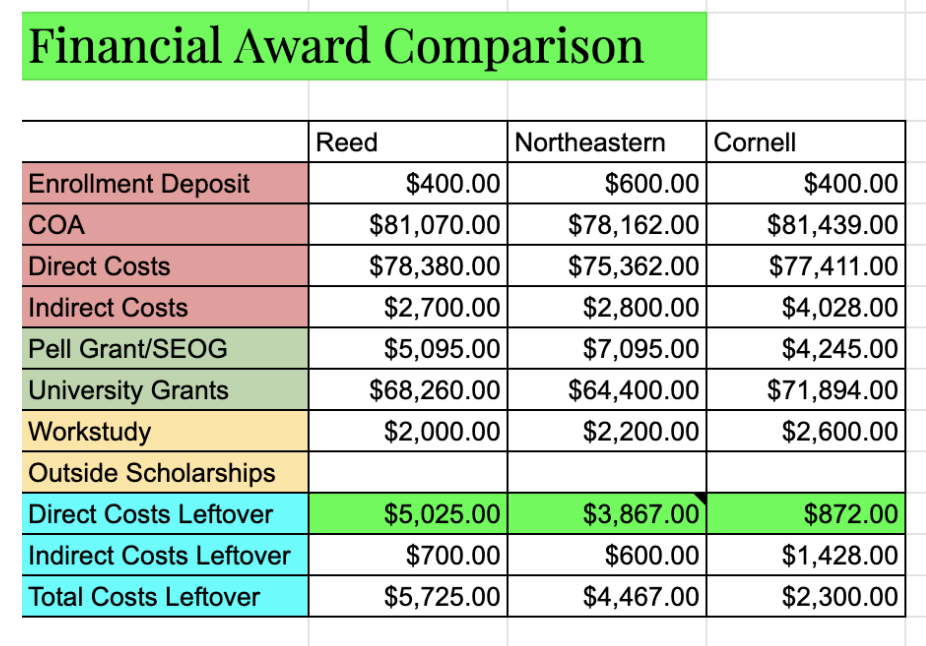

After receiving my financial aid awards, I also used spreadsheets to organize the financial aid letters and compare the offers from each school. Because this spreadsheet used information similar to what you would get in an NPC, you could use this format for the NPC spreadsheet as well.

Image is the author's original work via Google Sheets

These may not look appealing or comprehensible to you 🤷, and that’s okay! Use the tools at your disposal to organize your information in a way that makes sense to you and helps you assess your financial needs thoroughly. There are many tutorials available online on how to get organized with platforms such as Google Sheets and Notion.

What are Hidden Costs?

It doesn’t stop, does it? While I hate to be the bearer of bad news, there are more expenses you should be aware of other than the cost of attendance. Some colleges will include a few of these (like flights ✈️) into the cost of attendance but still may not cover them. These hidden costs can rack up between an extra $1,000 to $4,000 a year. Being aware of these expenses can help you be prepared and comfortable when they arise.

Here are some expenses 💳 that may sneak up on you if you aren’t prepared.

Sneaky Expenses:

- Activity and club fees

- Textbooks and lab notebooks

- Transportation (flights, Ubers, bus passes)

- Clothes (getting a nice winter jacket or interview clothes)

- Parking permits and fees

- Greek life

- Eating and hanging out with friends

- Dorm supplies (mattress pads are expensive y’all!)

Check out more about college prices at four year colleges and a guide to financial aid during college.

You can do this!

This may seem like a lot of information and steps all at once, but you are fully capable of making it through this process! Pace yourself and be aware of important dates and deadlines 🗓 so that you are not stressing to fill out paperwork last minute. Use people around you as a resource, reach out to financial aid counselors at any school you are applying to with any questions.

Lastly, take care of yourself, and don’t be afraid to take a step back for a bit if it becomes overwhelming. You got this 😤!

Browse Study Guides By Unit

👛Paying for College

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.