J

Jeanne Stansak

AP Macroeconomics 💶

99 resourcesSee Units

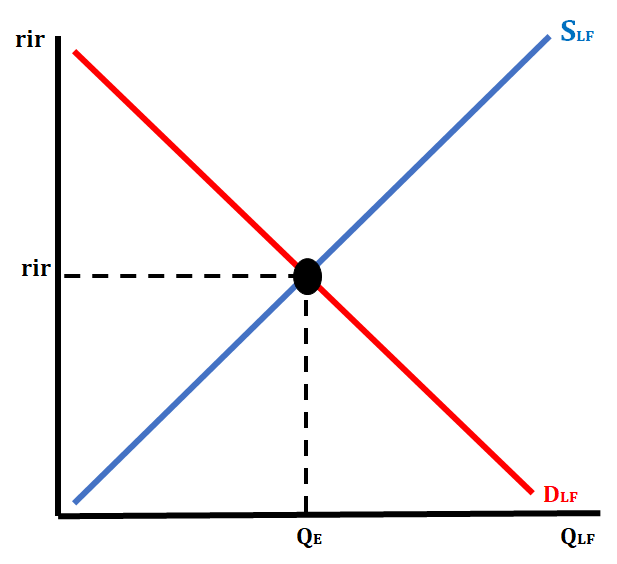

The loanable funds market illustrates the interaction of borrowers and savers in the economy. Borrowers demand loanable funds, and savers supply loanable funds. The market is in equilibrium when the real interest rate adjusts to the point that the amount of borrowing equals the amount of saving.

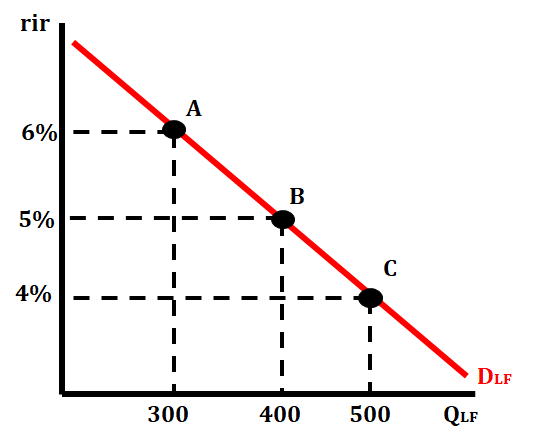

Demand of Loanable Funds

The quantity of credit wanted and needed at every real interest rate by borrowers in an economy. The relationship between real interest rates and the quantity of loanable funds demanded is inverse. As real interest rates rise, consumers and firms are less willing or less able to demand the same quantity of loanable funds, and therefore use and borrow less. As real interest rates fall, consumers and firms are more willing or more able to demand the same quantity of loanable funds, and therefore use and borrow more.

When real interest rates increase, the quantity of loanable funds demanded decreases.

When real interest rates decrease, the quantity of loanable funds demanded increases.

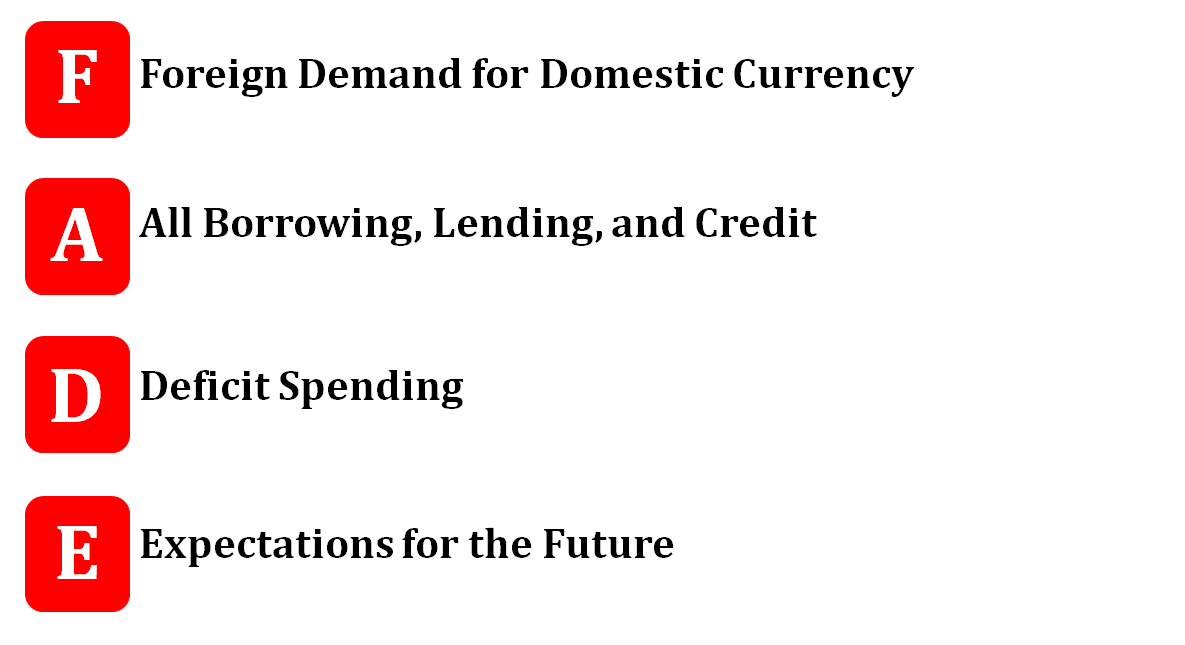

Shifters for the Demand Loanable Funds

Foreign Demand for Domestic Currency: When foreign investors want more of our currency to make purchases of our goods and services, we will see the demand for loanable funds increase. When we want to exchange our currency for another foreign currency, we will see a decrease in the demand for loanable funds.

All Borrowing, Lending, and Credit: When there is an increase in loans, credit, and borrowing by consumers and firms, we will see the demand for loanable funds increase. When there is a decrease in loans, credit, and borrowing by consumers and firms, we will see the demand for loanable funds decrease.

Deficit Spending: Deficit spending is when the government spends more money than they are bringing in with tax revenue. If deficit spending increases, there is an increase in the demand for loanable funds by the government to cover the additional spending not covered by tax revenues. If deficit spending decreases, there is a decrease in the demand for loanable funds because the government does not have the need for loanable funds to cover their additional spending due to tax revenues covering all spending.

Expectations for the Future: When the economy is strong and there are predictions for future growth, we will see an increase in the demand for loanable funds. In this situation, businesses are willing to borrow funds to make improvements or invest in their businesses. Consumers are also confident in the economy and are more willing to borrow funds. When there are concerns about the economy, we will see a decrease in the demand for loanable funds. In this situation, businesses will not be comfortable investing in their firms and less willing to borrow funds.

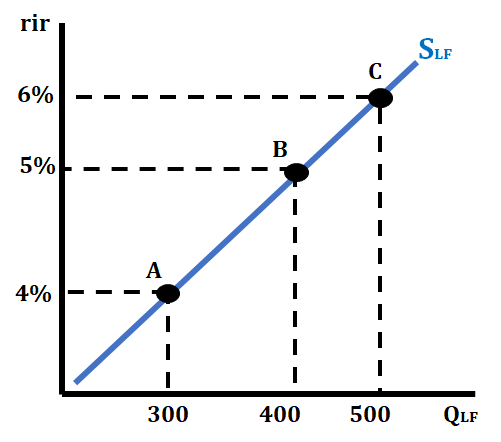

Supply of Loanable Funds

The supply of loanable funds is the quantity of credit provided at every real interest rates by banks and other lenders in an economy. The relationship between real interest rates and the quantity of loanable funds supplied is direct, or positive. As real interest rates fall, banks are less willing or less able to supply the same quantity of loanable funds, and, therefore, make less available. As real interest rates rise, banks are more willing or more able to supply the same quantity of loanable funds, and, therefore, make more available.

When real interest rates increase, the quantity of loanable funds supplied increases.

When real interest rates decrease, the quantity of loanable funds supplied decreases.

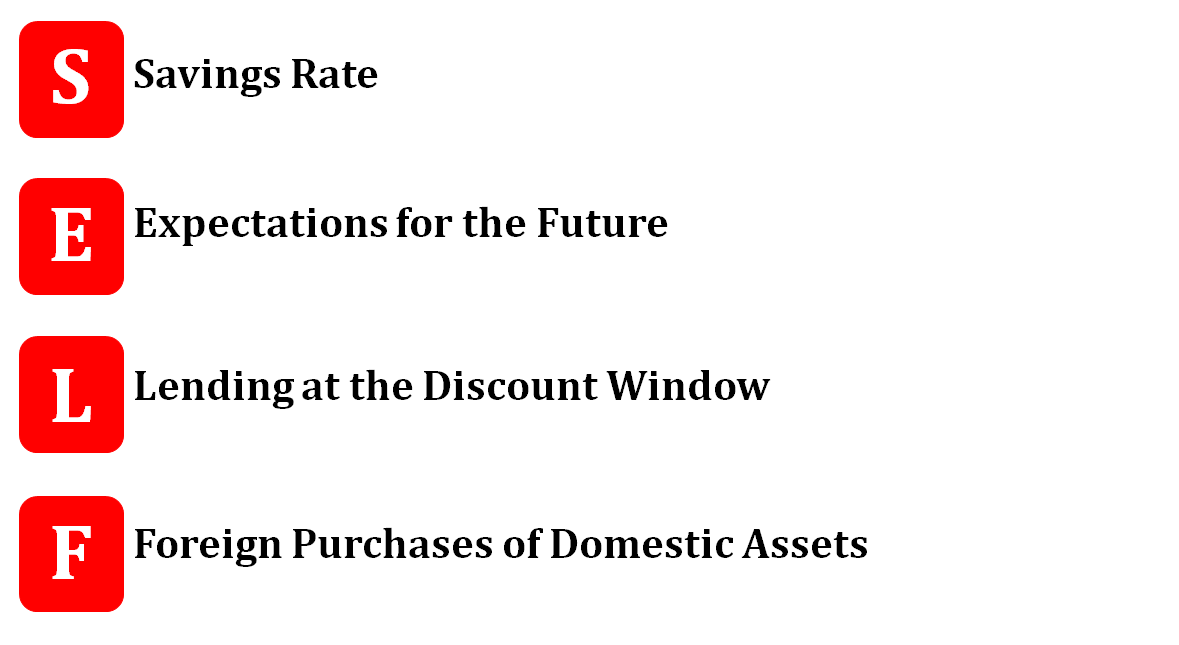

Determinants for the Supply of Loanable Funds

Savings Rate: When consumers slow their consumption and start putting more of their income into savings, the demand deposits increase. This will increase the number of reserves that banks can loan out, which will increase the supply of loanable funds. When consumers begin to increase their consumption, they are placing less of their income in the bank. This leads to fewer demand deposits and fewer reserves that can be loaned out by the government, decreasing the supply of loanable funds.

Expectations for the Future: When an economy is experiencing a contraction, consumers will begin to put more of their income into banks. This increases demand deposits and will give them greater reserves that they can loan out. This increase in reserves leads to an increase in the supply of loanable funds. If there is a high rate of inflation predicted, consumers will begin to withdraw their money from the bank in an effort to liquefy their assets and spend it on goods and services before prices rise. The pulling of their money from the banks will decrease the number of loanable funds.

Lending at the Discount Window: When the discount rate is decreased by the Federal Reserve, banks will be more willing to borrow funds, which leads to an increase in the supply of loanable funds. When the discount rate is increased by the Federal Reserve, banks will be less likely to borrow funds, which leads to a decrease in the supply of loanable funds.

Foreign Purchases of Domestic Assets: When a foreign investor chooses to increase their purchase of domestic assets like bonds, that places more money into the banking system and increases the supply of loanable funds. When a foreign investor chooses to decrease their purchase of domestic assets like bonds, that places less money into the banking system and decreases the supply of loanable funds.

Loanable Funds Market

When borrowers and lenders come together, we refer to this as the loanable funds market. We illustrate this by placing the demand and the supply of loanable funds on one graph. The real interest rate at which the quantity demanded of loanable funds equals the quantity supplied of loanable funds.

Whenever either the demand or supply of loanable funds increases or decreases then it will lead to a change in the real interest rate. This is because the equilibrium point where the quantity of loanable funds demanded and the quantity of loanable funds supplied are equal has changed.

When the demand for loanable funds increases then the real interest rate will increase.

When the demand for loanable funds decreases then the real interest rate will decrease.

When the supply of loanable funds increases then the real interest rate will decrease.

When the supply of loanable funds decreases then the real interest rate will increase.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.