Haseung Jun

AP Macroeconomics 💶

99 resourcesSee Units

Intro to Unit 4

The Financial Sector

We can't let the government have all the fun when the economy falls out of equilibrium! In this unit, we will explore how changes in the Money Market can affect our economy. These changes can come naturally but often result from the Monetary Policy carried out by the Federal Reserve Bank (the FED).

4.1 Financial Assets

Before we can dive into the FED and their economy stabilizing techniques, it will help review the basics of the financial sector. The basic building block of the financial sector is money 💰, and while we all interact with it daily, we might not know that we can hold other assets in place of money - like stocks, bonds, and other investments.

Each asset has different characteristics, and we often refer to them based on their liquidity, rate of return, and the amount of risk we take when holding that asset. In general, the more the risk - the greater the reward (or the more catastrophic the loss). While economics is vastly different from finance, this unit introduces some assets that cross into both disciplines, like stocks and bonds.

4.2 Nominal vs. Real Interest Rates

We hear about interest rates all the time: on TV, the radio, in the newspaper. The topic is almost inescapable. In Unit 4, we'll investigate how interest rates can affect other things, and we'll learn to identify both the nominal interest rate (not adjusted for inflation) and the real interest rate (adjusted for inflation). Finally, we will learn how to calculate these different rates and understand the relationship between them and the expected inflation rate.

4.3 Definition, Measurement, and Functions of Money

🎵Money, money, money….Mon-ey!🎶 (If you don't know that song - look it up!) We use it every day, but what do we really know about money 💵? There are three functions of money: medium of exchange, unit of account, and store of value; each will pop up in this unit. Additionally, we learn how the money supply is measured and included in each category (M1, M2, and M3).

4.4 Banking and the Expansion of the Money Market

Now that we've covered money, it is crucial to explore where we keep our money. No, I'm not talking about under the mattress! I am talking about the banking system 💲. Here in the United States, we use a fractional banking system, which essentially means that banks are only required to keep a fraction (hence the name) of their holdings in the vault. They are free to loan out most of the money that we deposit into the bank as demand deposits.

The money they are required to hold is called the required reserves. Before we freak out too much about the fact that our bank is lending out our deposits, know that there are excess reserves, which the banks keep on hand, above and beyond what is required.

This, of course, allows for another multiplier! The money multiplier allows us to calculate the amount of money that banks can generate from their excess reserves. It is an explanation of how banks can create money from thin air!

By dividing one by the reserve requirement (set by the FED), one can calculate the money multiplier. For example, a reserve requirement of 20% would create a money multiplier of 5 (1/.2). That means that a bank can create five times the amount of money as their excess reserves. A $100 deposit would create $80 in excess reserves ($20 would be required reserves) and up to $400 ($80 x 5) in brand new money!

Keeping track of all of these demand deposits and reserves can be a confusing task. Enter the Bank Balance Sheet (aka T-accounts) to save the day and keep things in order. This simple accounting tool allows one to separate the assets from the liabilities and keep them balanced (just like the name).

4.5 The Money Market

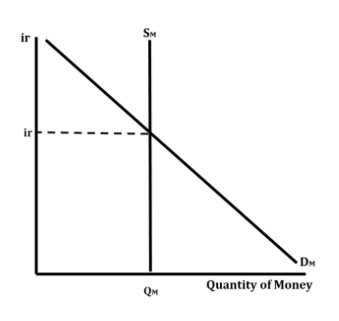

Now that we've explored money, we must dive into the money market. The demand curve for money looks much like every other demand curve that we have explored, but with nominal interest on the y axis. The quantity demanded of Money is only affected by the nominal interest rate (or the price of money). However, three things can shift the demand: Price Level, Real GDP, and Transaction Costs.

In this section of the unit, you will learn how and why these shifters affect the demand for money.

The FED determines the supply of money, which is independent of the nominal interest rate. That means the supply curve for money is a vertical line. The place where the two curves come together is the Money Market Equilibrium.

4.6 Monetary Policy

In the last unit, we looked at how the government interacts in the economy through fiscal policy. In this unit, we will explore the central bank's actions - or the Federal Reserve - known as monetary policy.

Like fiscal policy, these actions have two main goals: expansion and contraction. There are three main monetary policy tools: setting the discount rate (the interest rate that the FED charges banks), setting the reserve ratio/requirement (the percentage of all demand deposits that banks must hold), and open-market operations (the buying and selling of treasury bonds). Each of these tools can influence the money supply and, therefore, the economy as a whole.

4.7 The Loanable Funds Market

The last topic of this unit dives into the Loanable Funds Market, which illustrates the interaction between savers and borrowers in our economy. Like other markets we have looked at, a series of determinants affect the supply, demand, and equilibrium of the loanable funds market. Similarly to basic supply and demand, the loanable funds market uses the real interest rate on the y axis, and becomes the price of loanable funds.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.