J

Jeanne Stansak

Haseung Jun

AP Macroeconomics 💶

99 resourcesSee Units

Crowding Out

The crowding-out effect is the economic theory that public sector spending can lessen or eliminate private sector spending. It's where the government's budget deficit increases demand for loanable funds, but it reduces the amount of available loanable funds for private investors. It increases demand but also increases interest rates. Less investment happening by the private sector means the national economic growth is not happening. This reduces demand and brings the economy back to where it started: a recessionary gap.

Image Courtesy of Investopedia

In a sense, crowding out cancels out the effects of an expansionary fiscal policy.

Looking at the Graph

The federal government is the largest demander for loanable funds. For example, the government just borrowed a good portion of the bank’s loanable funds. You go to the bank for a car loan, however, the interest rate increased because the government owns a large portion of the funds. Demand for the loanable funds increased, so interest rates increased appropriately. You decide not to buy the car because the monthly payments and interest rates are too high. Other people make the same decision as you. This causes the demand for cars to drop and auto workers are laid off.

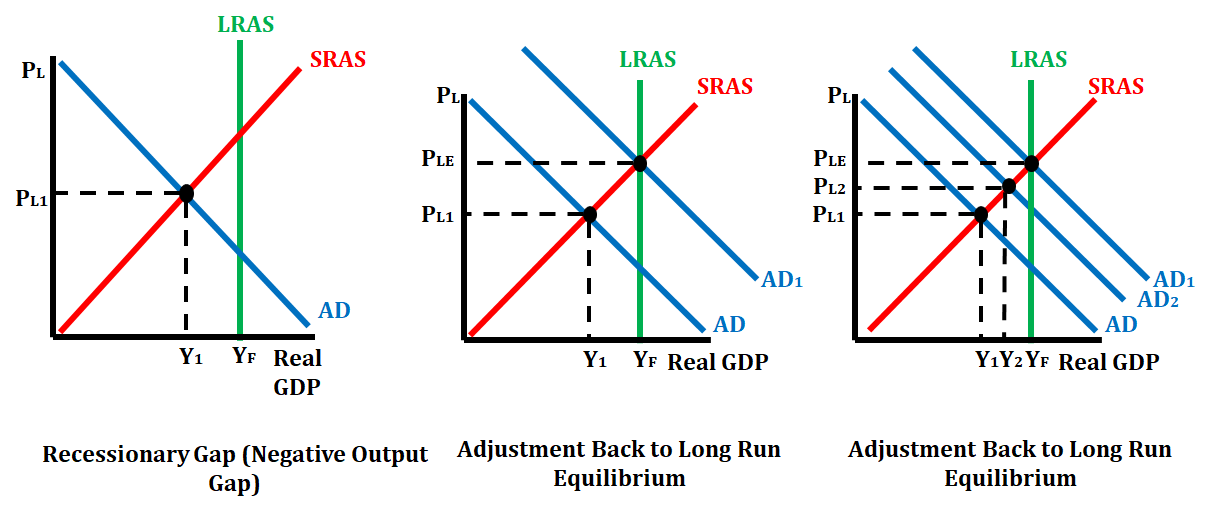

The graph on the left shows an economy in a recessionary gap. The graph in the middle shows the rightward shift of aggregate demand (AD) that can correct a recessionary gap when the government increases its spending in order to get the economy moving again. The graph on the right shows what can happen when crowding out occurs. Instead of government spending correcting the economy, they choose to spend money on a good or service that will decrease or eliminate private spending, causing the economy to move only from AD to AD2. When crowding out occurs, the economy does not quite get back to long-run equilibrium.

Long-Run Impact

Fortunately, crowding out is not always an issue. Sometimes, there will be enough loanable funds for everyone. The government borrows the loanable funds because it is already in a deficit and it goes into a even more deficit in order to save the economy from going into a depression. However, despite its efforts to fight off a looming depression by closing up the recessionary gap, crowding out can cancel out these efforts.

Economy

If this crowding out prolongs for a longer time, we will essentially come into a situation where economic growth is severely reduced. Our economy might start going downhill and widen the recessionary gap because more people are saving instead of spending, thus decreasing demand. This can cause the government to enact an expansionary fiscal policy, only to have it cancelled by crowding out. This can lead to a vicious cycle where the final destination is economic doom.

Infrastructure

Crowding out can have a serious impact on infrastructure too. If private investments decrease due to crowding out, more and more private firms will be discouraged from participating in infrastructure building because of low investment or because of its unprofitable nature. This can lead to a decrease or inefficiency in building things like roads, bridges and hospitals. It can also decrease the quality of the infrastructure as well.

Quick MCQ

The crowding-out effect from the government borrowing is best described as

A. the rightward shift in AD in response to the decreasing interest rates from contractionary fiscal policy.

B. the leftward shift in AD in response to the rising interest rates from expansionary fiscal policy.

C. the effect of the president increasing the money supply, which decreases real interest rates, and increases AD.

D. the effect on the economy of hearing the chairperson of the central bank say that they believe that the economy is in a recession.

E. the lower exports due to an appreciating dollar versus other currencies.

✨

✨

✨

✨

✨

✨

✨

✨

✨

Answer: B. the leftward shift in AD in response to the rising interest rates from expansionary fiscal policy.

Remember, crowding out is the cancelling of expansionary fiscal policy. The cause should be something related to expansionary fiscal policies. That only leaves with the answer B. Plus, it talks about the leftward shifting of AD, which is what happens when crowding-out effects take place. Expansionary fiscal policy shifts AD right, and crowding-out shifts AD left.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Economic Indicators & the Business Cycle

💲Unit 3 – National Income & Price Determination

💰Unit 4 – Financial Sector

⚖️Unit 5 – Long-Run Consequences of Stabilization Policies

🏗Unit 6 – Open Economy - International Trade & Finance

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.