J

Jeanne Stansak

dylan_black_2025

AP Microeconomics 🤑

95 resourcesSee Units

Refresher of a Uniformly Pricing Monopoly

Last section, we learn about a monopoly. A monopoly is a market structure in which the entire market is run by one firm who has complete control over the price and quantity produced. In a uniformly-pricing monopoly, the monopolist charges only one price - the demand price at the point where MR = MC. In a monopoly, MR is less than D because a monopoly must charge all consumers the same price, meaning they cannot take advantage of different willingnesses to pay. Even if the first consumer is willing to pay $50, if the price is $5, they must charge $5.

However, the monopolist doesn't have to uniformly-price (barring laws forcing them to). This section will discuss price-discrimination, the process by which a monopolist smashes consumer surplus and charges every consumer a different price - their exact willingness to pay.

What is Price Discrimination?

Price discrimination is a practice used by monopolies in which specific products are sold to different buyers and each consumer is charged the highest price that they are willing and able to pay. The price they are charged is based on their purchasing power and their demand elasticity. If a customer is willing to pay a lot, they're charged a lot. If they're willing to pay a little (up to the price where MR = MC), they're charged a little.

There are three conditions that need to be present in order for a monopoly to practice price discrimination:

- The firm must have monopoly power - you can't price discriminate without power over prices

- The firm must be able to segregate the market - this means being able to find out what each consumer's willingness to pay is

- Consumers cannot easily re-sell the product in the market - If consumers are able to easily resell the product, they may be able to arbitrage the price difference and undermine the monopoly's ability to price discriminate

There are many differences between a regular monopoly and one that price discriminates. Take a look at the table below for more information.

| Characteristics | Pure Monopoly | Price Discriminating Monopoly |

| Demand & MR | D > MR | D = MR |

| Efficiency | Productively and allocatively inefficient | Allocatively efficient, productively inefficient |

| Economic Profits | Smaller long-run economic profts | Larger long-run economic profits |

| Consumer Surplus | Some consumer surplus | Zero consumer surplus |

Graphing Perfect Price Discrimination

In perfect price discrimination (also called first degree price discrimination), demand exactly equals marginal revenue because we're able to earn exactly the additional willingness to pay for each additional unit, unlike before. Thus, we have three main curves on our graph: MC, which stays the same, D = MR, which is downward sloping, and ATC, which also doesn't change.

Total revenue looks like a trapezoid going down the demand curve, since we make different amounts of revenue per consumer.

Total cost is the same as always - the rectangle formed by ATC and the price.

The following graph shows profit in a price discriminating monopoly:

Take a look at all that profit! By price discriminating, the monopolist is able to convert all consumer surplus over to additional revenue, and as such, make tons more profit.

My face when I saw this graph for the first time - profits go WILD

Producer and Consumer Surplus in Price Discrimination

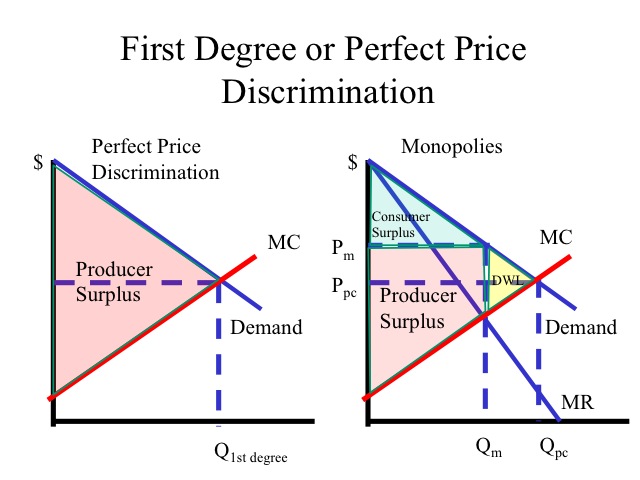

Let's observe what happens to producer and consumer surplus when we price discriminate. First, remember what surplus looked like in a uniformly-pricing monopoly:

We have consumer surplus, producer surplus, and deadweight loss from the non-socially optimal production.

In price discrimination, consumer surplus is wiped out to ZERO. This is because every consumer is charged exactly their willingness to pay, so they always make no surplus. Instead, this is converted to producer surplus, since the monopolist gets what would be their additional willingness to pay. However, we also have no deadweight loss, since we now are producing where P = MC.

Efficiency and Price Discrimination

When a monopoly price discriminates, it becomes allocatively efficient. A pure monopoly always produces less than a perfectly competitive market, meaning its level of output is not allocatively efficient. When a monopoly price discriminates, it earns a higher marginal revenue (MR), so it will increase its output and produce at the allocatively efficient level of output.

By price discriminating, a monopolistic firm will increase its economic profits. A pure monopoly charges a single price, where a price discriminator will charge each consumer at different prices. This eliminates consumer surplus and turns that into revenue, which in turn increases the economic profits that are earned by the firm.

Examples of various situations where monopolies are price discriminating include:

- An airline charging different prices to customers for the same flight. Many times the cost varies based on how much in advance the flight is booked (i.e. more expensive the closer you get to the actual flight) or based on your past ticket purchases. This is also called intertemporal price discrimination.

- A university charging different students different prices of admission

- A sports team charging different prices for seats in the same section of a stadium.

- A car dealership negotiating car prices with consumers on an individual basis.

- A movie theater charging different prices for tickets based on a consumers age.

Browse Study Guides By Unit

💸Unit 1 – Basic Economic Concepts

📈Unit 2 – Supply & Demand

🏋🏼♀️Unit 3 – Production, Cost, & the Perfect Competition Model

⛹🏼♀️Unit 4 – Imperfect Competition

💰Unit 5 – Factor Markets

🏛Unit 6 – Market Failure & the Role of Government

🤔Exam Skills

📚Study Tools

Fiveable

Resources

© 2025 Fiveable Inc. All rights reserved.